Your Index Investments Likely aren't as Diversified as You Think

Large cap indices are dominated by a few large stocks. What to know and how to get more diversified.

Index investing gained popularity in the 1990’s and 2000’s, largely because it was an easy and cost effective way to get broad exposure to the stock market. Investors learned that being exposed to just a few stocks greatly increased their risks. Further, for anyone generating income from their portfolio, we previously posted on how volatility increases Sequence of Returns Risk and the detriment that has on Safe Withdrawal Rates.

How it Used to be, How it is Now

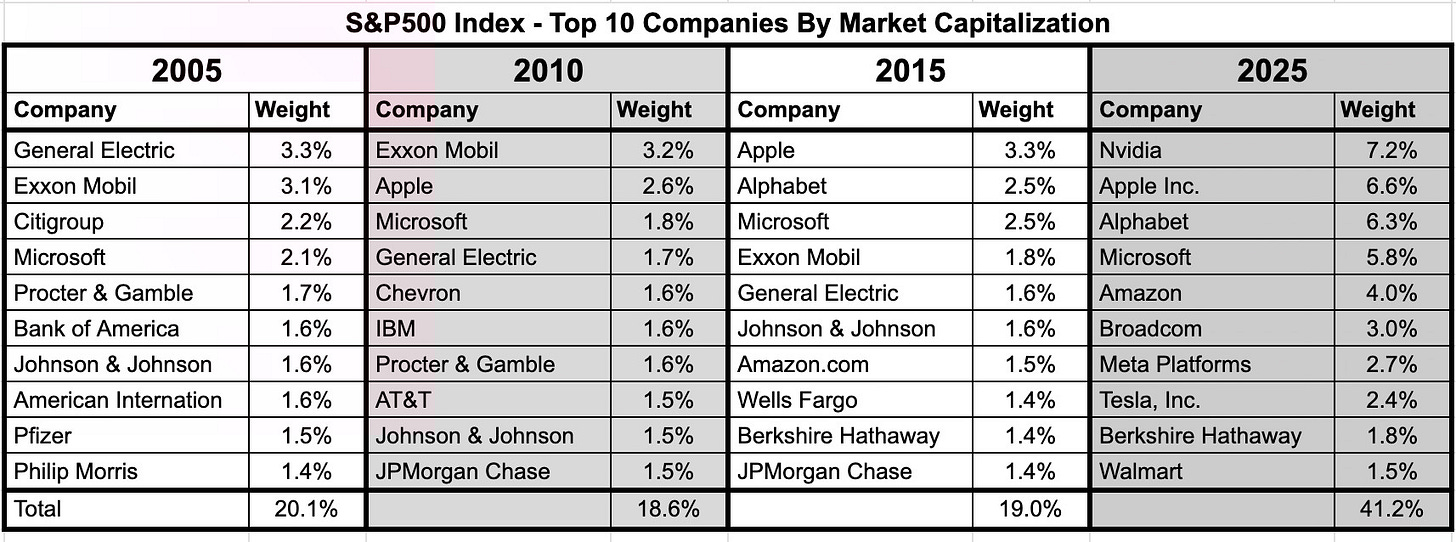

Above is table showing the top 10 companies in the S&P500, by market capitalization (share price * shares outstanding), from 2005-2025. (References: 1, 2)

- From 2005-2015, the 10 largest companies in the S&P500 represented about 20% of the total weight of the index, versus over 40% in 2025. This demonstrates a significant increase in market concentration.

- From 2005-2015, the 5 largest companies in the S&P500 each represented 1.6%-3.3% of the index; versus 4.0%-7.2% in 2025. (The largest company, Nvidia, holds a weight of over 7%.)

Some Background

What is Market Capitalization?

Market capitalization (frequently abbreviated “market cap”) is just the price of a stock multiplied by the total number of shares outstanding. Basically it is the price you’d pay for the company if you tried to buy all the shares. (Well, not really, because if you tried that, people would notice and that alone would move the price higher.) Fundamentally, it is a way to answer the question “how much does the stock market think this company is worth?”

Types of Stock Indices

Stock indices can be composed several ways; two common ways are market cap weighted and equal weight.

- Market cap weighted index: Each stocks impact on the index price is “weighted” based on its market cap. If you own an ETF that tracks a market cap weighted index, your money is effectively buying an amount of stock in each company according to its weight in the index.

- Equal weight index: All stocks have the same weight on the index price. If you own an ETF that tracks an equal weighted index, your money is effectively invested equally in every company in the index.

- Both statements above have the caveat that indices are only periodically updated to reflect constituent weights; frequent changes would wreak havoc for fund managers.

Why Does This Matter?

All that brings us to this fact:

If you hold an S&P500 index fund (like SPY, VOO, IVV, etc.), you have essentially invested 40+% of your money into just 10 companies.

What About the Nasdaq 100?

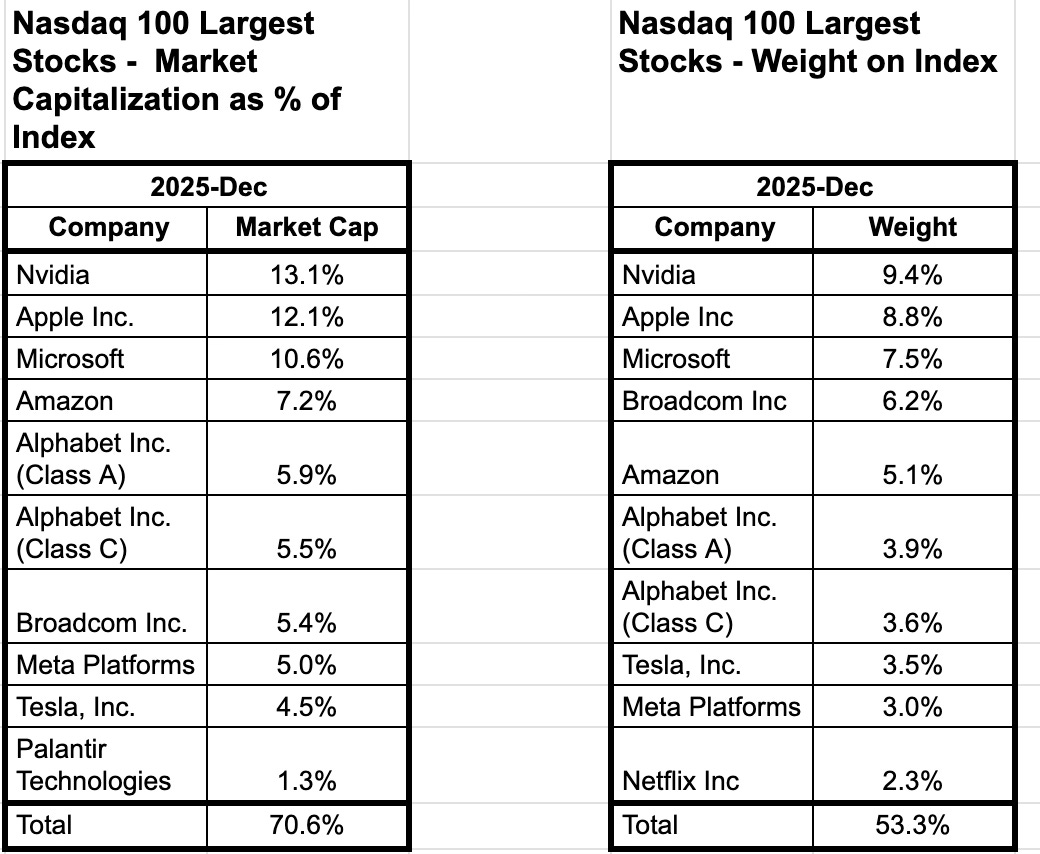

Nasdaq 100 index market cap and index weights of the 10 largest companies

The Nasdaq 100 index is represented in the ETF world by ETFs like QQQ and QQQM.

The Nasdaq 100 index is a modified market cap weight index; whereby there are rules to limit the impact of a few large stocks on the index value. The left table is what the weights of each company would be on the index in a purely market cap weighted index. With “modified market cap weight“ it is actually the weights as shown in the right table.

The top 10 stocks in the Nasdaq 100 index currently have an unadjusted market cap weight of roughly 70% of the index total (left table above), while their current adjusted weights “only” represent about 53% of the index (right table above). (References: 1, 2)

- Even with the modified weights, 37% of the Nasdaq 100 Index is composed of just 5 stocks.

Details on Nasdaq 100 Index Methodology

In 2023, Nasdaq implemented a “special rebalance” to this effect; more on their methodology here. There have only been 2 prior special rebalances. Key from the linked methodology document:

- The aggregate weight of the companies whose weights exceed 4.5% may not exceed 48%.

What to Do?

If you were buying index funds 10 or more years ago, you likely didn’t make the purchase thinking:

I really want about half my money in 10 stocks, and the other half in diversified investment(s).

Simple Solution

The indices that stand out as having a problem with diversification are the S&P500, Nasdaq 100, and Nasdaq Composite.

The simple solution to this is to recognize that market cap weighted index investing is not as diversified as it once was, and find ETFs that use equal (or other suitable) weighting.

Examples:

Another solution is an ETF that excludes the largest stocks from the index. An example of this is XMAG (Defiance Large Cap ex-Mag 7 ETF); “The First ETF Offering Exposure to the S&P 500 Excluding the “Magnificent 7” Tech Giants“.

I expect we will see more products like this as demand for investment diversification will drive product development in the ETF space.

(The above products are for reference to the type of product suggested; this is not an endorsement of any of the products.)

Fundamentally, you first have to recognize the problem. Hopefully this post helped with that. Now you need to review your investment holdings and decide what, if any, actions to take.

Ready to learn more?

Dive deeper into investing, saving, and withdrawal strategies through our comprehensive Learning Track.

Prefer updates in your inbox? Subscribe via Substack to get all our content delivered straight to you via email.

We love hearing from our readers. If you have questions about this post, or want to suggest a topic for a future article, please use the Chat link on our Substack home page to reach out.

Thanks for reading! This post is public so feel free to share it.

Disclaimer

**For Educational Purposes Only:** All content on this site, including articles, tools, and simulations, is for informational and educational purposes only. It should not be construed as financial, investment, legal, or tax advice. The information provided is general in nature and not tailored to any individual’s specific circumstances.

**Software Development Has Inherent Risks:** The software used to perform the analyses may have errors or inaccuracies. When we post updates to any material, errors or inaccuracies that are subsequently fixed may change the results.

**No Guarantees & Risk of Loss:** The analyses and simulations presented are based on historical data. Past performance is not an indicator or guarantee of future results. All investing involves risk, including the possible loss of principal. Market conditions are subject to change, and the future may not resemble the past.

**No Fiduciary Relationship:** Your use of this information does not create a fiduciary or professional advisory relationship. We are not acting as your financial advisor.

**Consult a Professional:** You should always conduct your own research and due diligence. Before making any financial decisions, it is essential to consult with a qualified and licensed financial professional who can assess your individual situation and objectives. We disclaim any liability for actions taken or not taken based on the content of this site.

* Nobody associated with Algorithmic Fire LLC has any credential(s) or affiliation(s) with any licensing or regulatory bodies, including but not limited to: Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA).

© 2025 Algorithmic Fire LLC. All rights reserved.